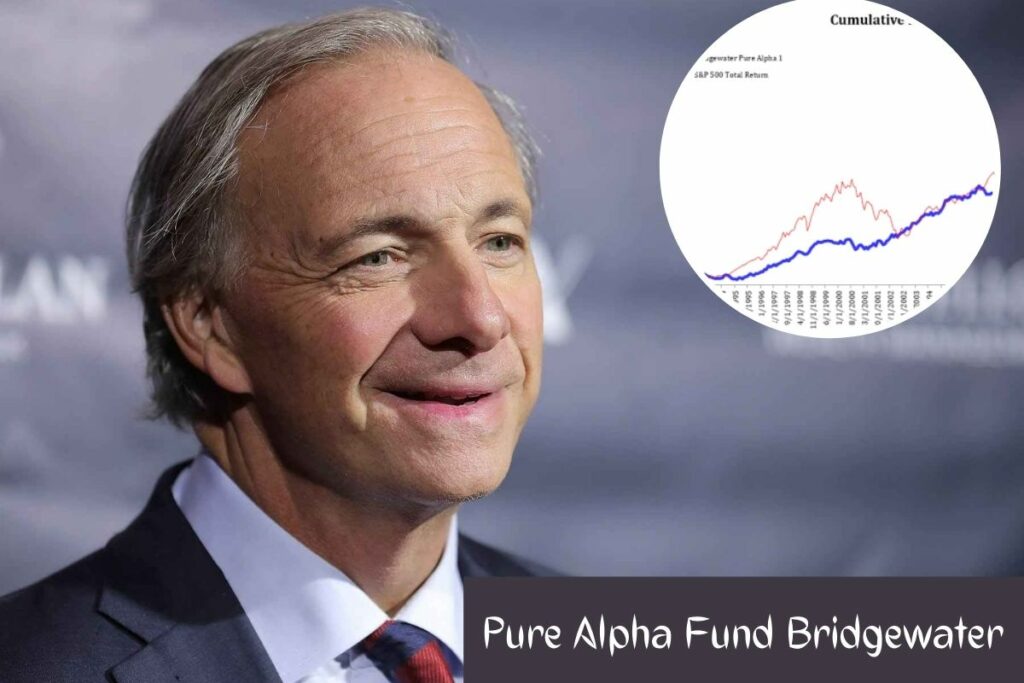

On Wednesday, Bridgewater Associates founder Ray Dalio said that the current political division in the United States is the greatest in more than a century and even worse than the polarisation that existed during the Civil Rights Movement in the 1960s. Also, he said that Bridgewater’s Pure Alpha fund is up 25% this year, which is lower than the 32% gain through June that Bloomberg News reported earlier this year but still far higher than the 16% increase of the S&P 500 SPX.

In an interview with MarketWatch editor-in-chief Mark DeCambre, which served as the opening event of the first annual MarketWatch “Best New Ideas in Money” Festival, Dalio noted that the United States is seeing “the highest degree of internal turmoil since roughly 1900. “More so than in Germany in the 1930s,” he remarked.

When pressed for specifics on the criteria he employs, Dalio mentioned the widening gap between the rich and the poor and the partisan divide between Democrats and Republicans.

“The Republicans are more conservative than they have ever been, and the Democrats are more liberal,” Dalio said.

“The voting across party lines is the least it has been since 1900,” Dalio added.

“You have the largest wealth gap that’s existed…you have a big internal debate over practically everything,” he said.

Like former President Trump’s claims that incumbent President Joe Biden “stole” the 2020 election, neither major party will likely accept the results of the following U.S. presidential election in 2024.

“It’s an ideological conflict,” Dalio said.

And he worries that a U.S. economic downturn will deepen the rift.

“If you have a bad set of economic circumstances, people get angry. And they should since some of them are suffering,” Dalio said.

Further aggravating the current economic situation in the United States and maybe the world at large is the rising possibility of a trade war between the United States and China.

“Twenty-two percent of all manufactured goods and imports come from China,” Dalio said.

“If you were in a situation where China was like Russia, in other words it’s not cool to invest or produce there, that economic impact would be an enormous,” Dalio said.

Returning to the topic of the stock market, Dalio shared some tips for amateur investors.

“We are in a period where most of the assets are going down,” Dalio said.

“The most important thing that you can do is have a well-balanced portfolio,” he said. Instead of trying to time the market, investors should focus on diversification he said.

He also suggested that individuals assess the safety of their assets in absolute terms. For instance, you should probably invest in inflation-indexed bonds instead of purchasing nominal bonds.

“The biggest problem of most retail investors have is that they think when something goes up a lot, it’s a good investment — and not that it’s more expensive,” he said.

As their talk drew to a close, DeCambre queried Dalio about Bridgewater Associates’ recent investment performance.